The Relevancy Analysis

Authors: Julio Guevara & Juergen Roesger

A powerful method to accelerate and successfully improve marketing communication, campaigns, content and product development

Understanding and perceiving the world and the needs of customers through their own eyes

The current challenges of customer interaction in a digital world

As noted by other areas of CDXE.de, customers value an experience that is tailored to them. In a survey conducted by Salesforce, 84% of customers said that customer experience is at least as important as the product itself, and a large proportion of them said they would pay a premium for a good customer experience. This has been additionally confirmed in a HBR and Master Card conducted study. In that study, more than 45% said they would gladly pay more for a good experience. Over 65% also said that they are drawn to a brand or product that puts the customer and the customer experience at the center of its efforts.

Consumers put customer experience high on their wish list (Source: Harvard Business Review)

Within the current market situation, an excellent customer experience can be the edge to stay ahead of the competitors. In this case, relevancy can be used to achieve a better experience for customers.

One of the core drivers for a positive experience perception is the customer's feeling of being understood and receiving suitable offers and information on the topics that are relevant to them at the moment. Therefore, the big challenge is to understand what the customer wants and how my product or service can solve the problems and meet the needs in a contextually relevant manner.

In this article, we will show how the method of relevancy analysis can be used to analyze, in a customer-centric fashion, the needs and requirements of potential customers in order to enable companies to develop, produce, and deploy content, offers, and campaigns that are relevant to these.

The customer journey is not closed and linear, it is a complex layered use case-driven process

A product is intended to satisfy a specific need and fulfill a function. But in order to know this, it is important to look into the context of our customers.

Context is crucial when analyzing the real motivations and needs from customers. To put it in perspective, the classical “marketing funnel” can be thought of as the final result of a real problem or question, for example: a person might want to be more conscious about how sustainable their lifestyle is, but they do not know where to start. So they decide to search for information about “global warming”, “clean energy” and “how to save electricity”. Through this process they jump from topic to topic until they are made aware of how to make an impact through the active choice of sustainable forms of transportation. This creates the urge and need to purchase an electric vehicle.

User journey from sustainability to electric vehicles (Source: IMG)

The real value lies behind understanding what causes a person to want to buy a service or product. Measuring relevance and contextualizing each step of the process can help find the connection between the product “electric car” and the actual and current user needs “a sustainable lifestyle”.

Understanding customer's northstar and needs is essential but with current methods is not realistic

In order to obtain insights about their customers‘ needs companies have turned to a handful of methodologies. But is there even a method to really understand the context and know which topics are of interest for a specific product? Is there a method that tells us what is relevant to our customers and what is not?

Maybe. But not quite yet.

The contextualization of a user need can be achieved through a deeper analysis of this search and user data, but at the moment we see industry experts relying solely on qualitative methods in order to get this much needed contextualization. The main issue with qualitative methods is that they lack scalability. They are tightly constrained by their size and their feasibility, as is the case for usability testing and focus group research.

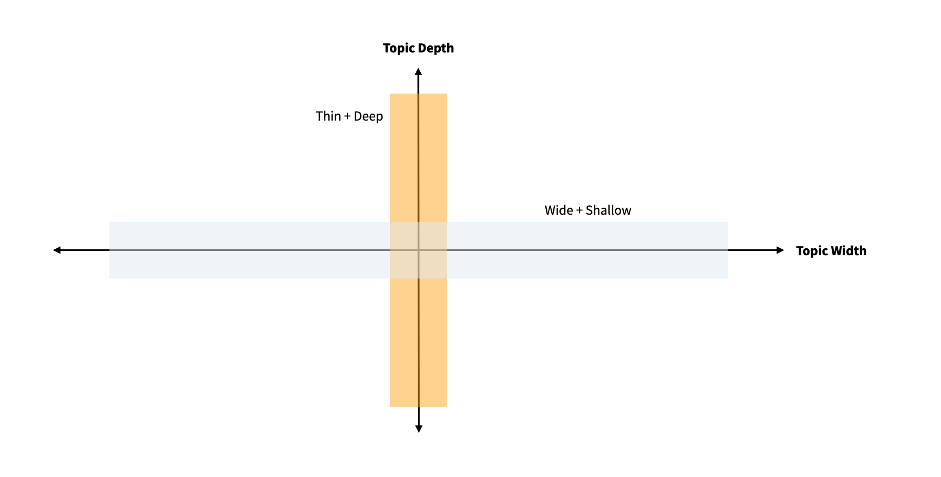

The areas of marketing and UX research fall dramatically short when trying to obtain real insight into customers' needs due to the tradeoffs that each of their current methodologies has to make for it to obtain them. After all, we either explore a topic in a wide audience with a shallow focus, or in a thin audience with deep focus.

At least until now.

Topic depth vs. topic width (Source: IMG)

Let’s see an example.

There is an almost obligatory practice under the discipline of SEO, where experts try to quantify users’ needs through a process called keyword research. In short, a keyword research is a process in which an SEO expert, or an expert from the industry itself, embarks on an explorative gathering of key terms (keywords) for which a domain might want to be found in search engines. Amongst the keyword data gathered there are different related terms, synonyms and their search volume (the amount of times a keyword was searched by users) of each term and in some cases even insights into the competitive landscape of the keywords.

Why is this process so popular?

Well, there is an estimate of 2 Trillion searches per year in Google’s search engine alone. Figuring out what users are searching for is a good thermometer for the current market’s demand of a specific product or service.

Nevertheless, there is one big problem with this plain quantitative approach and that is its one-dimensionality. The context of these search queries, the “why” behind the “what”, the actual need behind the searchers intent, has to be inferred and assumed from the keywords found. The search volume of a topic, although a valid proxy to measure user demand or interest, does not give any insights into other aspects of the intent behind it, for instance, the users’ opinions towards a certain topic or related interest areas of users that cause this need in the first place.

Context is ignored.

This means that on the one hand, quantitative methods (like a keyword research or a classical survey) do not take customer’s context into account, on the other hand qualitative research misses the validation and power of scalable methods.

Here we find ourselves at a crossroad. How can we get the in-depth contextual information that is necessary to understand the needs of customers without giving up the sturdiness of a massive quantitative method? And most importantly:

How do we find a topic map to help us navigate through the underlying motivations and desires of customers across the complete customer journey?

In this article we want to propose an approach that solves this. A process designed to understand customers’ needs that is big in scale, leaning on a primarily quantitative nature, while simultaneously taking customers’ context into account. A process we call the relevancy analysis.

How to exploit and analyze available data

Collecting and utilizing data in a relevancy analysis (Source: IMG)

New data and information technologies have allowed us to size up our research efforts, wide and deep. Data banks have expanded, newer metrics have been developed, tools and methods have been born, and information has been democratized and made more accessible. The relevancy analysis leverages the power of automation and artificial intelligence and the richness of the currently available data sources of consumer insights within the web in order to collect all of the necessary insights to truly understand customers.

By taking advantage of these current technological advancements we are able to make many contextual nuances visible (like our electric car example) as we measure different “contextual proxies” - relevance, semantics, search volume and sentiment - thereby winning a clearer image of our customers’ needs and wants that would otherwise not be possible through traditional techniques.

The secret of the relevancy analysis: What is even happening in the engine room?

First of all there is one thing that we need to understand: a relevancy analysis is an iterative data gathering process that helps quantify and prioritize each step of the customer journey and puts it into a context.

Why do we iterate it? Because one topic field usually uncovers the potential of a new related topic field that was not taken into consideration for the initial data gathering. Although quantitative in nature, the relevancy analysis is an exploratory research process that puzzles together every step of an ever changing customer journey.

How the data magnet works for collecting suitable data (Source: IMG)

At different stages of the process users might need different types of information; inspirational (“how to save energy?”), informative (“what is the most sustainable method of transportation”), comparative (“CO2 emissions electric car vs. normal car”), actionable (“electric car test drive”), etc.

Each step of the way plays an important role in the purchase process. The key is to be able to keep up with the “on-demand society” we have created, presenting the right information or service in order to fill a specific need at the right time.

Here is how we approach this:

Leveraging the power of Big Data to view a broader picture

First of all, we need to solve the problem of scalability. Here is when the data gathering process comes into place. In the relevancy analysis we can leverage millions of search data points to measure the level of interest of a given group of keywords (for example about a specific topic like electric cars).

For example, if the search volume for “electric car trunk space” is higher than “electric car horsepower”, one can make an educated assumption that the trunk space of an electric car is more relevant to our customers than the horsepower. Assumptions like this can also be made, not only for search queries with a purchase intent, but for any type of search queries. Customers use search engines to clarify any doubts that they have regarding virtually any topic; the relevancy analysis exploits this.

Google search recommendations (Source: Google)

We can use different data-bases to collect information about how many people are searching for a specific topic, product or service, or is there a specific season where the interest spikes in relevance. Such data-bases also allow us to see which organizations and companies are already being offered as a solution for the needs of our customers within the search results (and are thereby perceived as relevant).

Additionally we can implement web-scraping techniques to be ahead of the current trends in a specific industry or market. If a customer read about the newest products in a magazine, blog or newspaper, it would only make sense to mine these for additional information, for example related topics, upcoming trends or even the issues that are most talked about by a certain target audience, their influencers and thought leaders .

By noticing patterns of upcoming topics that show a sudden increment in search and speech volume (how often a specific term is talked about, commented on, liked or shared in the web) we have the possibility to recognize upcoming trends before they start booming.

How Artificial Intelligence can help connect quantitative data to qualitative nuances

Mentions, likes, shares and comments help us know which topics are being talked about the most each month and might be of current relevance for a topic niche.

Customers also have online conversations about products and services through forums and social media. The interactions hosted in these platforms can heavily change the perception of a topic or product, and carries valuable insights about the general feelings towards a topic by a specific audience. Here, customers come to vent, complain, review and praise all kinds of products and services. They express personal opinions, problems and frustrations.

These interactions can be exploited through the use of artificial intelligence, more specifically, through the sentiment analysis of topic niches. Not only do we get an overview of the speech volume of a topic, but also the sentimental tones which are used more often to refer to a topic and each specific aspect of it.

This can help uncover, for example, what problems do customers currently have within their journey. If the topic “electric vehicle recharge stations” is tainted with a negative sentiment in social media and the press, there is a high chance that customers are not satisfied with this specific aspect of the product and this needs to be addressed.

Automation and NLP (Natural Language Processing) helps us gain a higher amount of insights

What follows is a complex, yet elegant step of data handling: clean, combine and cluster.

The relevancy analysis is continued through an automated process, in which we clean the data by removing irrelevant data points, for instance duplicate terms and results without any speech or search volume.

After a quality check of the data pool, we break it down into smaller pieces of categories and subcategories. For this, we use leading edge NLP technologies for the classification of every keyword and term that we gathered. The algorithm we employ is similar to Google’s own methodology for topic clustering (word co-occurrence and bigraph co-clustering).

Our method surpasses the classical TF-IDF approach, rudimentary keyword cluster analysis and other classification algorithms (for instance methods based on LSA, LDA or document-clustering) by taking advantage of the context in which the words are used. To be more detailed, this is possible thanks to the information offered by the semantic relationships between words that are often used together (the co-occurrence frequency of individual keywords) in a highly specialized set of data gathered (the bi-graph co-clustering of the results taken as a base).

At this point is where we start drawing a picture of the real needs of consumers and see the differences and relationships between the layers of their customer journey.

How the previously collected data is handled in a relevancy analysis (Source: IMG)

What do people care about? What is relevant?

Working through the different groups of topic clusters and the questions surrounding these helps give a detailed overview of what aspects of a topic are more important to customers than others. We can see what categories are more important (“trunk”, “motor”, “color”, “tax cuts”, “sustainability”, etc.)

We can also know more precise information about each category, (“what brands or colors are the most popular amongst customers”) and discover new customer behaviours by comparing the results within and across categories (“people prefer big spacious cars when they have families, but small cars if they do not”). We can even find adjacent topics that would normally be completely overseen by other methodologies (“sustainability at home”, “smart cities”, “yoga and meditation”).

Subcategories and categories can then be prioritized based on the search and speech volume, as these are a clear signal for customer relevancy, while at the same time taking into account the product fit into these topics. All in all, this process allows us to find out which relationships exist between the different aspects of a product and the context of its customers and their individual needs.

At the end, this unravels as a topic map: a visual representation of the relationship between the brand in question and the context of its potential customers.

Creating a topic map to generate insights in the relevancy analysis (Source: IMG)

With the topic map, we are now in a position where we can create suitable content, services, and product offerings for the identified topics and the desires and requirements that stem from them, and place them in key places along the customer journey. Either at our own digital touchpoints, media partners, social media sites or influencer environments. In doing so, we achieve higher visibility in search engines for these context-relevant use cases, generate additional organic traffic in this way, and are thus able to bring previously unaddressed or difficult-to-address target groups into our commercial ecosystem. At the same time, we use this measure to claim unoccupied fields in search engines.

The relevancy analysis allows us to uncover and to understand which topics and themes are relevant to our potential customers.

References

A. Rennie, J. Protheroe, C. Charron and G. Breatnach. “Decoding Decisions - Making sense of the messy middle”. Think with Google 2020.

HBR Analytic Services. “The Value of Experience Customer Needs Top the Innovation Agenda”. Harvard Business Review, 2020 (Last checked June 2021).

Interactive Marketing Group. “Creating C-BEV leads by extending the funnel - A data driven approach”. 2017.

J. F. Allen, M. Swift, W. de Beaumont. “Deep Semantic Analysis of Text”. Semantics in Text Processing. STEP 2008 Conference Proceedings (Last checked June 2021).

J. Kong, A. Scott and G. M. Goerg. “Improving semantic topic clustering for search queries with word co-occurrence and bigraph co-clustering”. Google, Inc., 2016.

Salesforce Media. “Insights from 8,000 Consumers - Rethink Your Approach to Customer Engagement”. Salesforce, 2020 (Last checked June 2021).